special tax notice empower

Special Tax Notice Regarding Retirement Plan Payments Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from the_____INSERT NAME OF PLAN the Plan is eligible to be rolled over to an IRA or an employer plan. Special tax notice regarding plan payments.

Pdf Employees Empowerment Through In Service Training

For Payments Not from a Designated Roth Account Effective.

. The Special Tax Notice Regarding Plan Payments explains the tax consequences of taking a distribution from your Plan. Withdrawals eligible for rollover 30. A9164_402f Notice 0321 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period applies without regard to whether you have had a separation from service.

Loans treated as deemed. This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits. Usually it is included along with the distribution form.

Early withdrawal penalty 30. FA 403B Special Tax Notice Form. Special Tax Notice Contact information.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. Indiana Public Retirement System One North Capitol Ave Suite 001 Indianapolis IN 46204 Page 2 of 7 Special Tax Notice. This notice modifies the two safe harbor explanations in Notice 2018-74 2018-40 IRB.

The safe harbor explanations as. Our goal is to. As an employee of JPMorgan Chase you have the opportunity to participate in the JPMorgan Chase 401k Savings Plan one of the best ways for you to prepare for your retirement.

This notice is intended to help you decide whether to do such a rollover. We continue to add and enhance tools and support to improve taxpayers and tax professionals interactions with the IRS on whichever channel they prefer. Empower and Enable All Taxpayers to Meet Their Tax Obligations.

You are receiving this notice because all or a portion of a payment you are receiving from your retirement plan is eligible to be rolled over to an IRA or an employer plan. DC-4253-1105 Page 1 of 4. As a Plan participant you must receive these notices the Distribution Notice and the Special Tax Notice enclosed at least thirty 30 days prior to your distribution.

That means the Notice doesnt have to be provided until the participant elects a distribution. It explains when and how you can continue to defer federal income tax on your retirement savings when you receive a distribution. Special Tax Notice and tax reporting 31.

Assignment of 401欀尩 Plan account prohibited 31. Empower Representative Compensation. Empower Retirement is required to withhold mandatory 20 for federal income taxes on the taxable portion of your benefit distributed to you as a Cash Payment.

This disclosure describes compensation practices for Empower Retirement LLC Empower employees who interact with individual investors such as investors in retirement plans recordkept by Empower or investors in individual retirement or brokerage accounts offered through Empower or its affiliates. 529 that may be used to satisfy the requirement under 402f of the Internal Revenue Code Code that certain information be provided to recipients of eligible rollover distributions. Special Tax Notice Regarding Rollovers.

Power of attorney conservatorship and guardianship 31. The Default Investment Notice outlines your rights if you have not chosen funds but are making contributions to the Plan. Convey information needed before deciding how to.

This notice is provided to you because all or part of the payment. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. While the Tax Code allows plans to create their.

Net unrealized appreciation 29. Receiving this does not mean you are eligible for a distribution or that you have requested a distribution. Tax treatment of contribution types 29.

Rodriguez says Empower will be rolling out new programs this year. The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a review of Internal Revenue Service IRS publications specifically Publications 575 Pension and Annuity. Retirement Operations OMB No.

Special Tax Notice For Payments Not From a Designated Roth Account YOUR ROLLOVER OPTIONS. This notice is intended to help you decide. This notice explains how you can continue to defer federal income tax on your retirement savings in your retirement plan the Plan and contains important information you will need before you decide how to receive your Plan benefits.

Payments of employee stock ownership plan ESOP dividends. 401k Savings Plan Enrollment Guide. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan.

Corrective distributions of contributions that exceed tax law limitations. Qualified domestic relations order 31. This notice provides updated safe harbor explanations that reflect changes made to the Code that affect the information required to be provided in a 402f notice including sections 617 and 657 of the Economic Growth and Tax Relief Reconciliation Act of 2001 EGTRRA.

Explain how to defer federal income tax on 403 b savings. You may voluntarily elect to have additional withholding below. 402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS.

We will continue offering more programs in small business classes start-ups small business loans obtaining tax IDs and. We will empower taxpayers by making it easier for them to understand and meet their filing reporting and payment obligations. SECTION 1 - 402f NOTICE.

This notice is provided to you by. Office of Personnel Management Form Approved. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan.

The Plan is required to provide you with information that explains your distribution options and the federal income tax implications of a Plan distribution prior to the receipt of assets from your account.

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

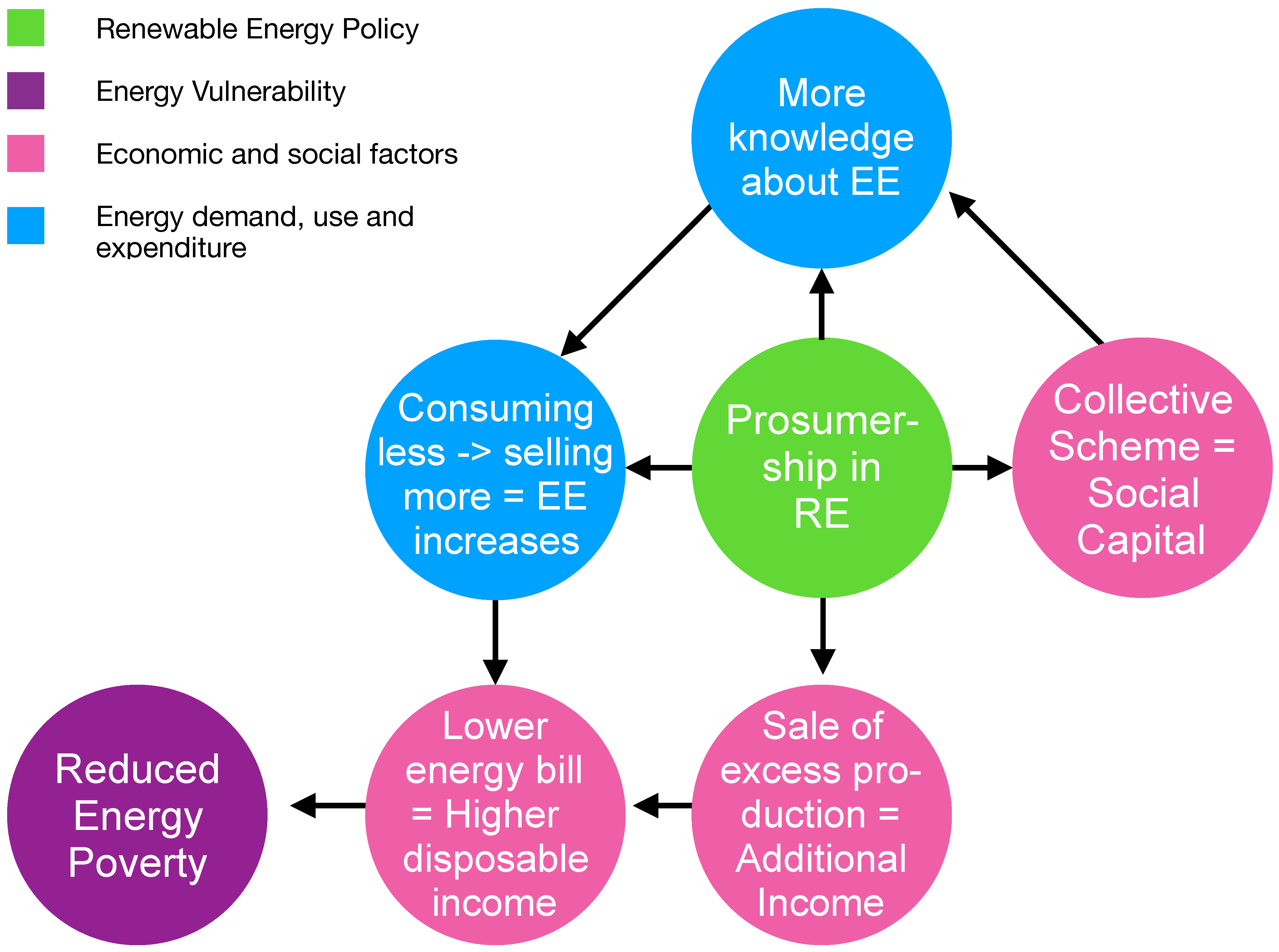

Energies Free Full Text Empowering Vulnerable Consumers To Join Renewable Energy Communities Towards An Inclusive Design Of The Clean Energy Package Html

Empower Taxpayers Internal Revenue Service

Empower Participants Bolster Retirement Savings Through Pandemic Business Wire

The Empath S Empowerment Deck 52 Cards To Guide And Inspire Sensitive People Orloff Judith Ray Elena 9781683648192 Books Amazon Ca

Pdf Stripping The Wallpaper Of Practice Empowering Social Workers To Tackle Poverty

Pdf Behavior Change Or Empowerment On The Ethics Of Health Promotion Goals

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

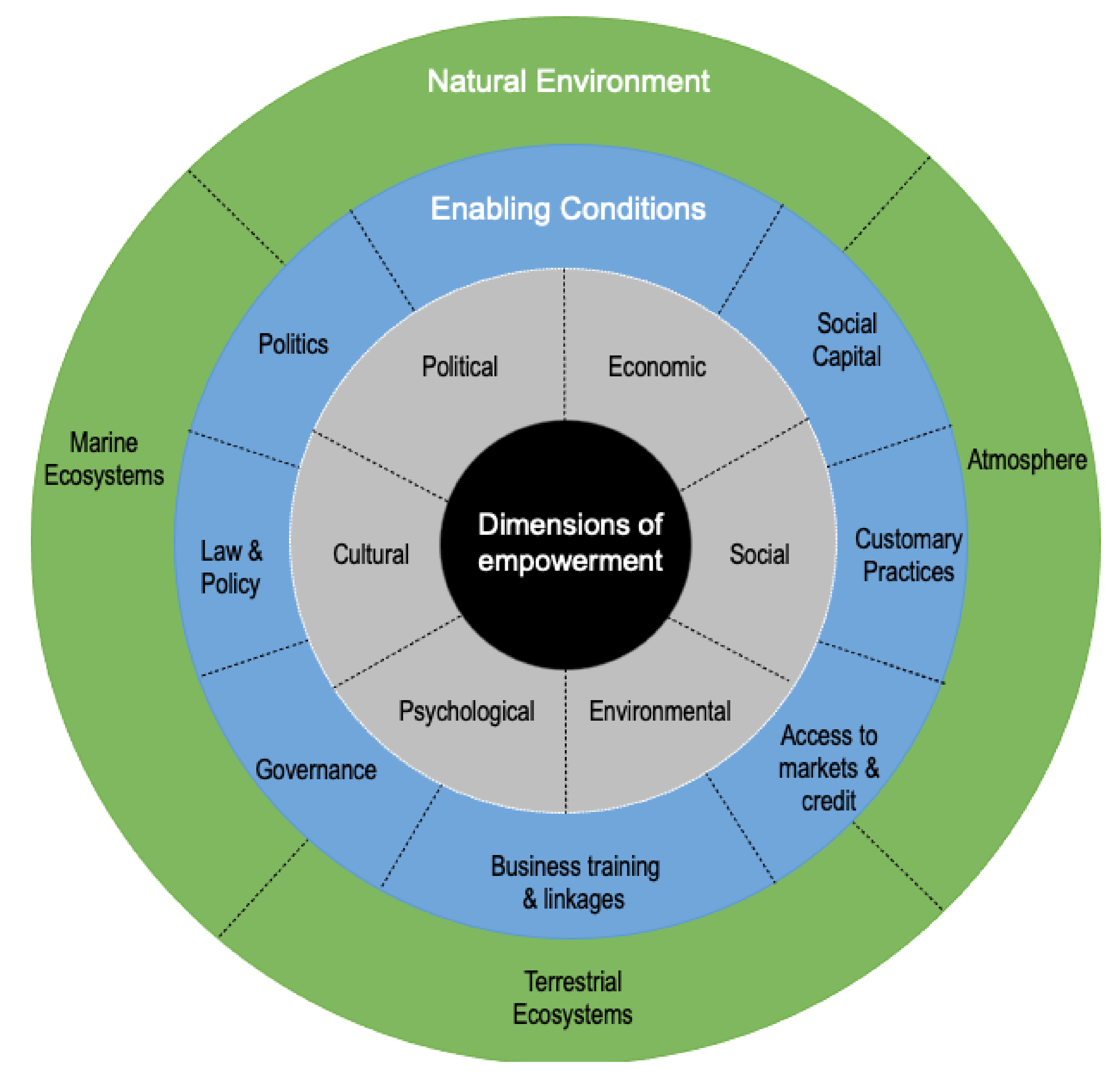

Sustainability Free Full Text Tourism Empowerment And Sustainable Development A New Framework For Analysis Html

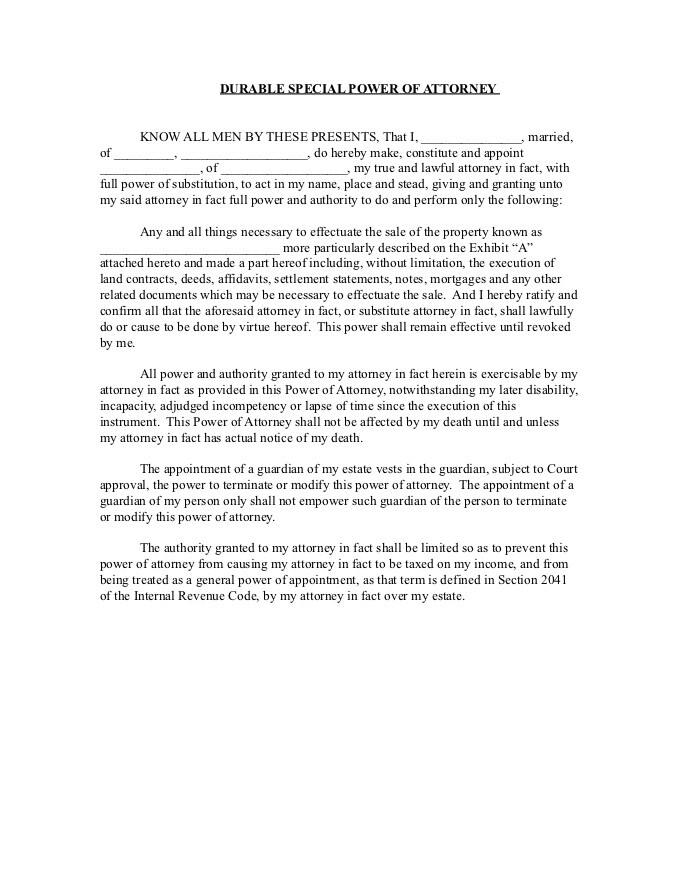

Get A Durable Power Of Attorney Template For Your Business

Pdf Technology As The Key To Women S Empowerment A Scoping Review

Empower Renames To Bolster Engagement With Customers Business Wire